Did You Lose Money Last Quarter?

March 27, 2019

Seems like a simple enough question. Based upon equity performance on a stand-alone basis, the newspapers, television and radio reports would have you think that you “lost a bundle”. Certainly, the market value of many investors’ portfolios was reduced throughout the last quarter of 2018. But was it really a loss?

Webster’s Dictionary Defines Loss as:

Loss: Amount by which the cost exceeds the selling price.

It is understandable that if you sell something for less than what you paid, you will have suffered a loss. But what if no sale takes place? A sort of loss? A quasi loss? Or how about simply negative returns? Undoubtedly negative returns are the first step to losses. However, negative returns only become losses when they are made permanent by a sale.

By participating in the capital markets, you are accepting the risk of a decline in the market value of your portfolio over the short term. You can expect to be rewarded with higher returns than risk-free alternatives, overall, in the long term. The additional returns in the long term are relative to the magnitude of short-term decline you are prepared to accept.

Pictures can say a lot…

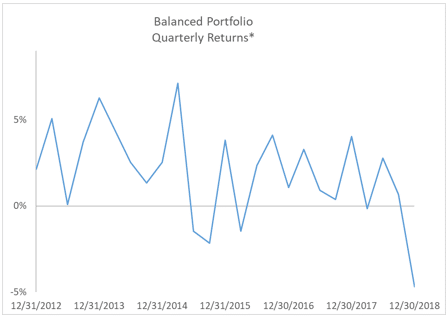

The chart below represents a simplified example based on index performance for the average portfolio of a Canadian investor who is invested 40% in Canadian fixed income and 60% in equities (split equally across Canadian, U.S. and international sectors). Returns for the past five years are shown on a quarterly basis. It looks like a bumpy ride. This is how many of you may feel in looking at the quarterly performance of your portfolio.

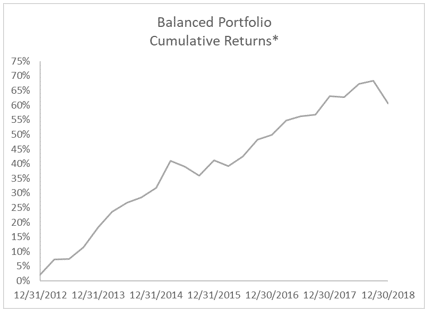

However, it’s important to look at the return of your portfolio over an entire period of time in order to get a complete picture. The following chart is based on the same portfolio as the previous example. Returns for the past five years are shown on a cumulative basis. The same ride looks much smoother.

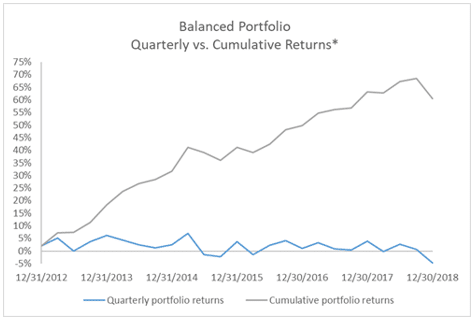

Short-term negative returns are a natural part of capital market cycles and a part of long-term portfolio growth. One of the main objectives of the Investment Policy Process at Quadrant Private Wealth is to work with our clients to ensure that exposure to such declines does not exceed a client’s maximum tolerance to accept them. By doing this, we can increase clients’ awareness and understanding of the ebbs and flows of the capital markets so that clients will allow their portfolio the time to grow appropriately over the long term. The bottom line is to avoid turning negative returns into absolute losses by exiting the marketplace when things appear rough.

Coming back to the question we posed at the outset of this article: “Did you lose money last quarter?”, we would suggest that rather than losses, you endured negative returns. If you have been participating in the capital markets over the past five years, the decline is simply a “repayment” of excess returns earned in previous years. If you are new to the capital markets, it is a loan to those markets that you expect to be repaid to you in future periods. In the long-term, each of you can expect to attain returns commensurate with the short-term declines you are prepared to accept. The key to obtaining these returns is to stay the long-term course set for your portfolio and avoid turning negative returns into losses.

About Us

Disciplined. Compassionate. Effective.

Quadrant Private Wealth is an independent, comprehensive, integrated wealth management firm committed to your financial well-being and peace of mind. We take the time to understand your complete financial picture. We tie all of your information together, including tax planning, to paint a picture of what your financial future could look like. And we aim to earn your complete confidence in the process.

Quadrant Private Wealth

Suite 720, One Lombard Pl

Winnipeg, MB

Ph: (204) 944-8124

email: inquiries@quadrantprivate.com

web: www.quadrantprivate.com

Disclaimer

This report may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Quadrant Private Wealth ("Quadrant"). Any unauthorized use or disclosure is prohibited. The information herein was obtained from various sources believed to be reliable but Quadrant does not guarantee its accuracy. Neither Quadrant nor any director, officer or employee of Quadrant accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this report or its content. The opinions, estimates and projections contained in this report are as of the date indicated and are subject to change without notice. Certain of the statements may contain forward-looking statements which involve known and unknown risk, uncertainties and other factors which may cause the results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Past performance is not indicative of future performance. The content of this report is intended for information purposes only and does not constitute an offer to buy or sell our products or services.